Ready about get control of your finances and build a secure future? You'll never be a more crucial time now to craft savvy savings strategies. By a little planning and {discipline|commitment, you can alter your financial landscape.

Start by creating a budget that shows your revenue and costs. Identify areas where you can trim spending thus devote more funds for savings. Investigate various saving {options|choices, such as high-yield savings accounts, certificates of deposit, or investment {accounts|plans.

Remember that consistency is essential when it comes to saving. Even small {contributions|sums can add up significantly over time. Make saving an fundamental part of your weekly routine and watch your savings {grow|increase.

Unlocking Savings Secrets: Simple Tips for a Brighter Financial Future

Saving money doesn't have to be tough. By implementing a few simple tips and tricks, you can pave the way to a brighter financial future.

Start by observing your spending habits. Use a budgeting app or spreadsheet to note every expense, big or small. This will give you where your money is going and help you identify areas where you can trim.

- Another effective strategy is to establish financial goals. Whether it's saving for a down payment on a house, a dream vacation, or retirement, having clear objectives will motivate you to stay on track.

- Consider programming your savings. Set up regular transfers from your checking account to your savings account each month. This way, you'll be saving without even noticing about it!

- Research different savings options. High-yield savings accounts, money market accounts, and certificates of deposit (CDs) can offer better interest rates than traditional savings accounts.

Remember, even small changes can make a big difference over time. By developing smart saving habits today, you'll be well on your way to financial freedom tomorrow.

Get Ahead Financially: Simple Tips for Monthly Savings

Take control harness your finances and build a brighter future with the power of budgeting. It's not just about tracking expenses; it's about making conscious choices that support your financial objectives. Begin by creating a detailed budget that outlines your income and expenses.

Pinpoint areas where you can minimize spending, even small changes can accumulate over time. Consider using budgeting apps or tools to simplify the process and stay on path.

Establish realistic savings objectives that are both challenging and achievable. Automate regular transfers from your checking account to a separate savings vehicle to ensure consistent progress.

Review your budget regularly, tweaking as needed to reflect any changes in your earnings or expenses. By implementing these simple budgeting basics, you can unlock the power of savings and achieve your financial dreams.

Boost Your Income & Turbocharge Your Savings

Want to ease your financial load? Explore the world of side hustles! This provide a fantastic way to create extra cash while cultivating valuable skills. Whether you're a creative individual, a tech pro, or simply someone with free time, there's a side hustle perfect for you.

- Utilize into your passions and convert them into profitable ventures.

- Freelance in areas like writing, design, or virtual assistance.

- Monetize your hobbies by selling goods online.

With a little innovation, you can unlock new income streams and obtain financial freedom.

Dominate Your Finances

Want to maximize your savings and reveal financial freedom? It all starts with a solid plan to trim unnecessary expenses. This isn't about deprivation; it's about making strategic choices that empower your financial future.

First, audit your spending habits. Track every dollar for a month to identify where your money is going. You might be astounded by what you find! Once you have a clear view, start incorporating these proven amc stock strategies:

* **Cut Subscriptions:** That streaming service you barely use? The gym membership gathering dust? wave farewell.

* **Prepare More Meals at Home:** Eating out is a budget drainer.

* **Embrace Secondhand Shopping:** Score amazing deals on clothes, furniture, and more.

* **Bargain Bills:** You might be able to secure lower rates for internet, phone, and insurance.

Remember, every little bit adds up. Start simple and build momentum over time. With dedication and a little planning, you can achieve your financial goals and enjoy the benefits of a secure future.

Achieve Financial Freedom Blueprint: Develop Wealth Through Strategic Savings Habits

Embark on a journey toward financial independence by establishing sound savings practices. A well-structured savings plan is the cornerstone of long-term wealth accumulation. Start by formulating a budget that monitors your income and spending. Identify areas where you can trim non-essential spending to redirect funds for savings. Set realistic savings goals that match your financial aspirations. Consider utilizing automatic transfers to contribute a consistent amount into your savings account each month.

- Diversify your savings across different asset classes, such as stocks, bonds, and real estate, to mitigate risk.

- Explore investment options that offer the potential for long-term growth, while staying informed about market fluctuations.

- Engage professional financial advice to develop a personalized savings and investment strategy.

Remember that building wealth is a process that requires persistence. By fostering smart savings habits, you can pave the way toward a secure and prosperous future.

Danny Tamberelli Then & Now!

Danny Tamberelli Then & Now! Kenan Thompson Then & Now!

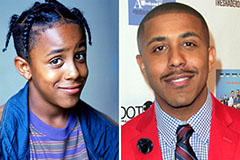

Kenan Thompson Then & Now! Marques Houston Then & Now!

Marques Houston Then & Now! Danny Pintauro Then & Now!

Danny Pintauro Then & Now! The Olsen Twins Then & Now!

The Olsen Twins Then & Now!